Stop loss

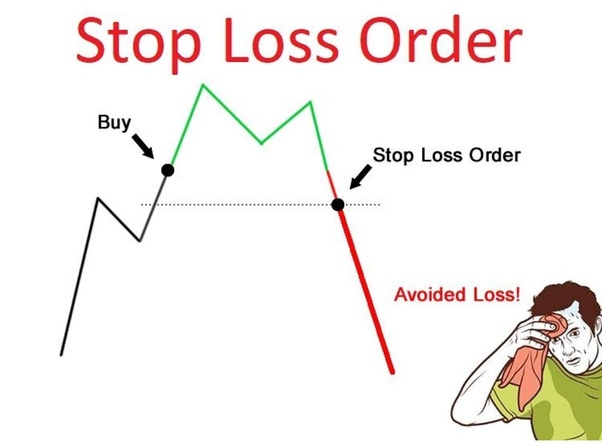

When you buy a stock, your expectation is that the stock price will go up.

But, there is a risk that the price goes down; as protection against this scenario you use what is call an “Stop loss”.

Basically, at the time that you buy an stock, you put a condition to resell the shares if the price hits a lower “stop” price. This reselling price, or stop loss, is how much you are willing to risk in a trade if things do no go the way you think.

Figure 2.13: Stop loss

Stop losses are also be used when shorting a stock. In this case, you would put an stop loss at a higher price that you bought it at. In the case of shorting, your risk is for the stock to go high in price.

Figure 2.14: Stop loss