Stop-Limit orders

In stocks where there is large volatility or not much liquidity (not enough shares traded), there is always a risk of what is call slippage, basically the price can increase or decline rapidly. Under these conditions, if you enter a market order (trade at best available price) you may risk for the order to be traded at very different prices than you expected. The Stop-Limit orders are used as protection against this situations.

The stop-Limit is identical to the stop order, but rather than triggering a market order (selling at whichever price is available), it triggers a limit order (filling at or better price that you set as limit).

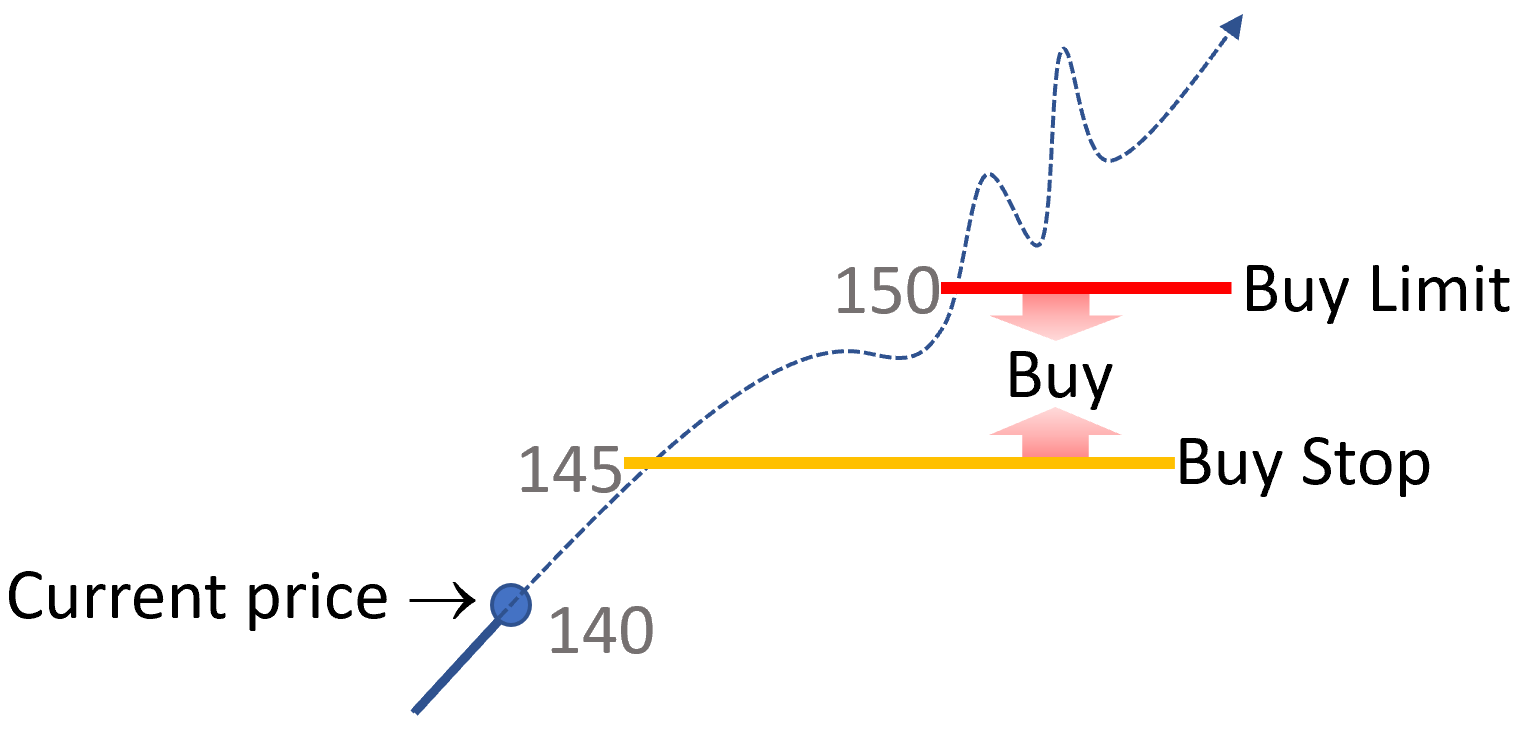

Lets consider the example below, in which you think the price is in a bull trend. So you want to buy low with the expectation to sell high later. However, if by any random chance the price slips upwards, you may ended up purchasing at too high of a price. To protect against this, you can set a buy stop-limit order. Buy only when prices reach the stop price but below the limit price.

Figure 2.10: Buy Stop Limit order

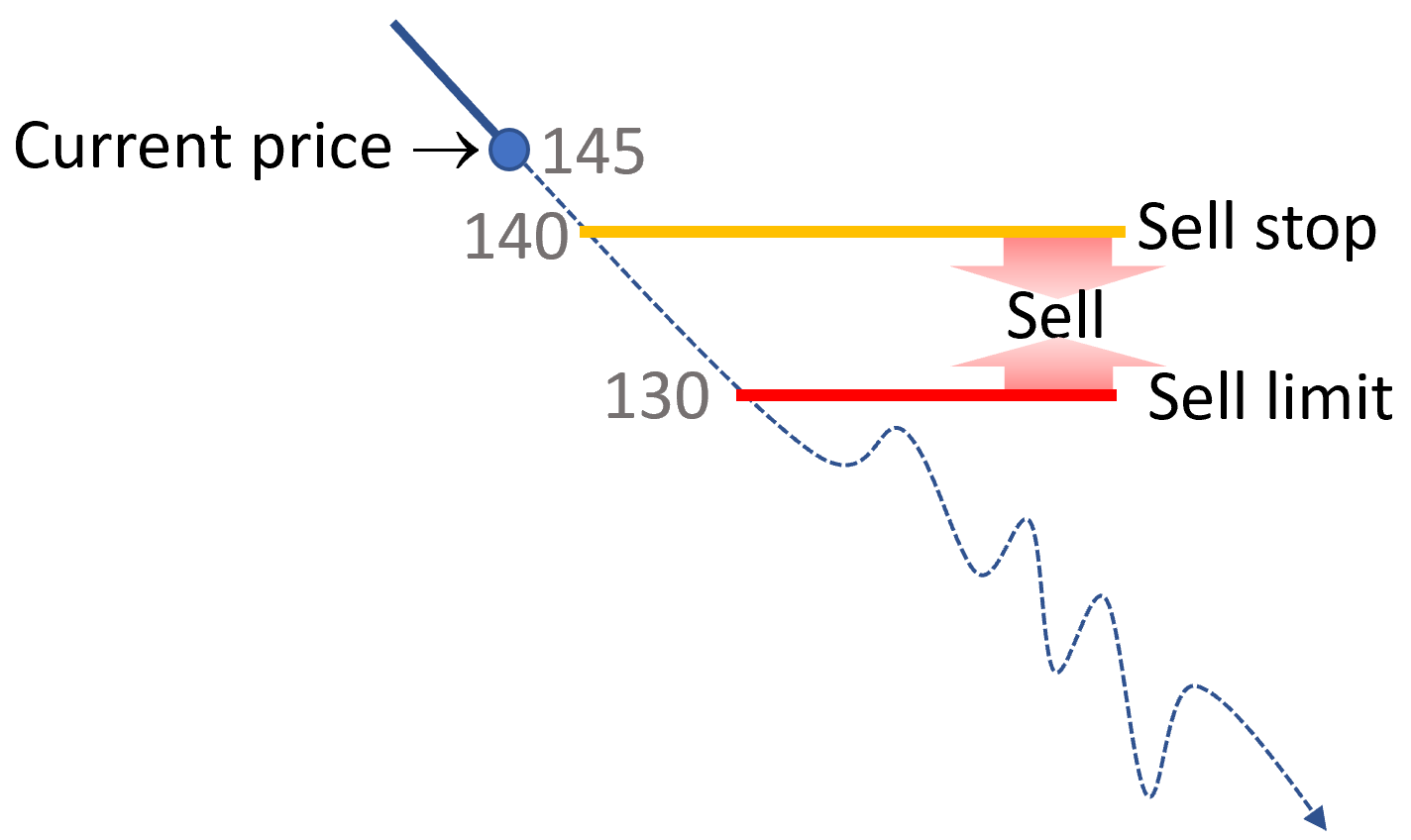

Figure 2.11: Sell Stop Limit