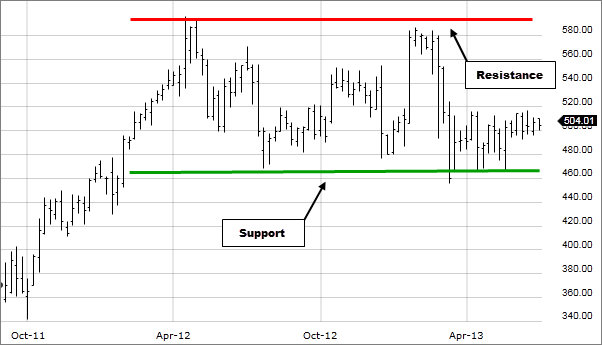

Resistance and support

When looking at the price of a stock over time, you will see that there are prices below which the price does not go. That lower threshold is called a support. That is the price supporting the given stock.

At times, you will see the price never going beyond a certain price. That given threshold is called a resistance. The price resist to go above that price.

Figure 2.21: Resistance and support

It is common that when a there is a breakthrough a resistance, the resistance then becomes the support.

There are numerous reasons for why the supports and resistance prices occur.

A support could emerge, for instance, at prices at which many buyers want to buy (e.g., they may think that stock is cheap at that price), at this given price demand is higher than the supply, and this tends to increase price above the certain value. That price creates a support.

The opposite could be said about resistances, which could be seeing at prices at which supply becomes larger demand; the price cannot rise above that level because high supply by sellers wanting to close positions at that price to take profits or opening short position around that particular price. At resistance levels, the supply of stock from sellers is larger than there is demand from buyers, as a result price tends to move below that price. The price resists to move above that resistance price.

At times, support and resistance prices can also be set by the amount of shares that were bought or shorted at the given price. An indicator called Volume profiles display the prices at which shares have been most commonly bought.

Support or resistance values can also occur at round numbers. Something above the price going above or below a round number makes people tickle.