33 Price gap

Gaps are fast changes in price that cause the open price to be much lower or higher than the close price. This occurs with large price orders, in stocks with small liquidity or an overreaction. These gaps can indicate several things depending on where they occur along the price trend.

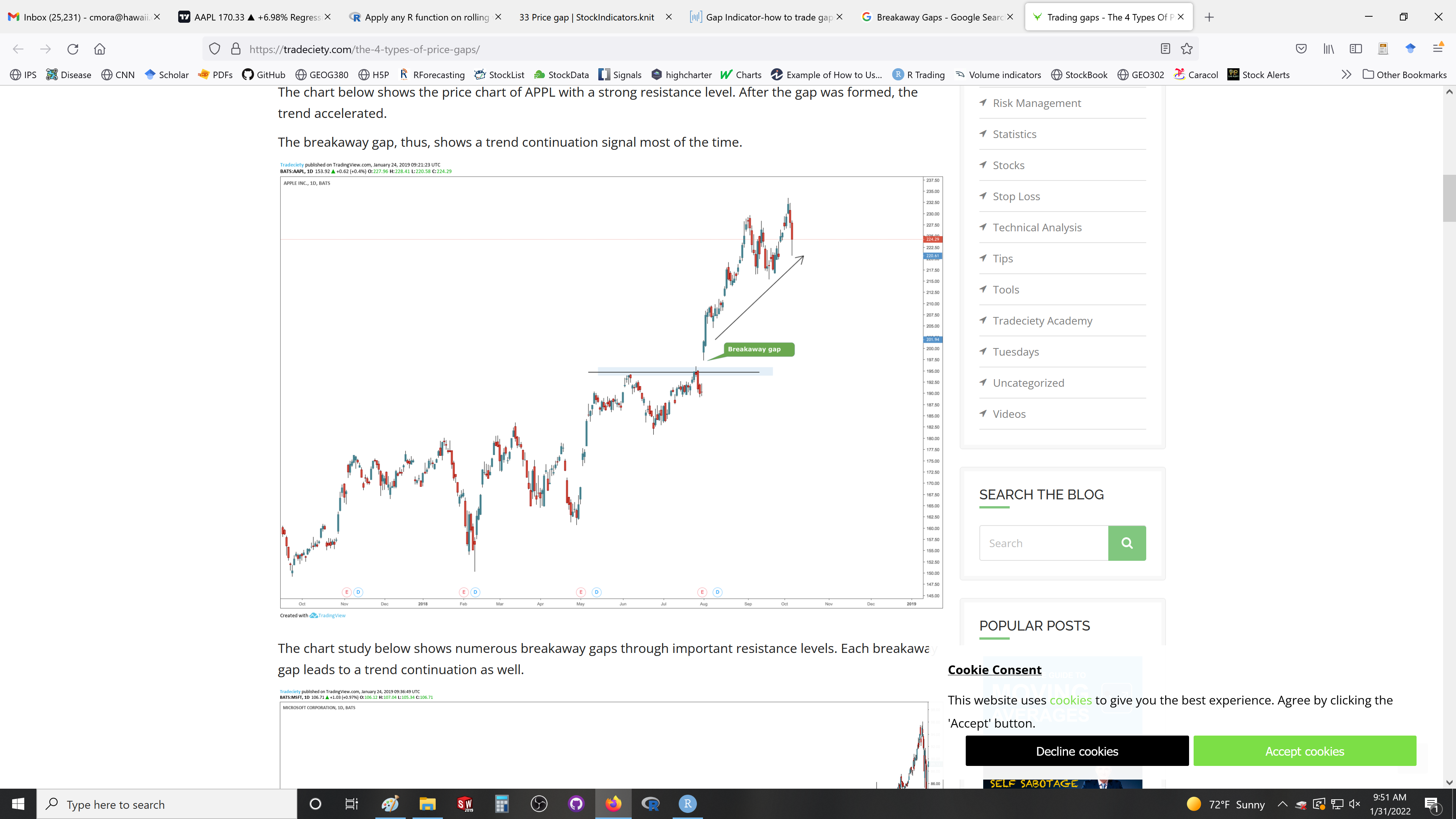

Breakaway gaps occur after a consolidation period. Mark the start of a trend. The direction of the price change indicates whether it is bull or bear trend.

Figure 8.46: Breakaway Price gap

Exhaustion gap usually happens during a trending period and can signal an end to tpe price movement or reversal.

Figure 8.47: Exhaustion Price gap

Continuation gaps occur in the middle of trends. In an uptrend, a gap upwards signals a continuation and it shows that additional buyers entered the market to push price higher.

Preferably, continuation gaps are not extremely large in size to confirm sustainability. Any extreme price or gap movements might foreshadow a shift in the buyer and seller dynamic.

Figure 8.48: Continuation Price gap

Common Gaps occur during consolidate prices and have not significnat reason behind them.

Figure 8.49: Common Price gap

Things to keep in mind:

Once a stock has started to fill the gap, it will rarely stop, because there is often no immediate support or resistance.

Exhaustion gaps and continuation gaps predict the price moving in two different directions—be sure you correctly classify the gap you are going to play.

Retail investors are the ones who usually exhibit irrational exuberance; however, institutional investors may play along to help their portfolios, so be careful when using this indicator and wait for the price to start to break before taking a position.

Be sure to watch the volume. High volume should be present in breakaway gaps, while low volume should occur in exhaustion gaps.