Debt-to-equity Ratio

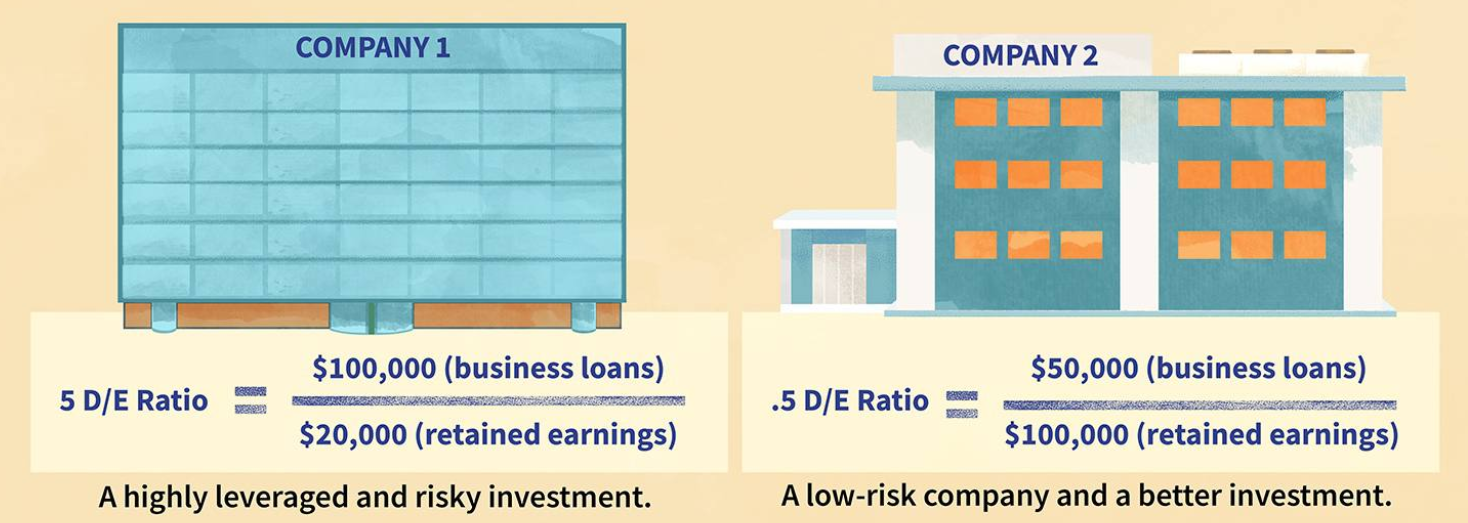

As the name imply, this index divides the debt of a company by its equity.

A larger than 1 Debt-to-equity Ratio implies the company owns more than it is worth.

Figure 6.10: Debt-to-equity examples

But a high Debt-to-equity Ratio can mean different things:

- the company can be at risk of defaulting on loans, if interest rates were to increase.

- The company can leverage good returns on debt. Basically, it gets a lot of money back for money that it loans.

The difference above highlights the need to use the Debt-to-equity Ratio in combination with other indicators.