144 Relative to past Week’s High Low

At least two strategies can be identified for using current price to prior weeks high and lows:

Donchians weekly rule

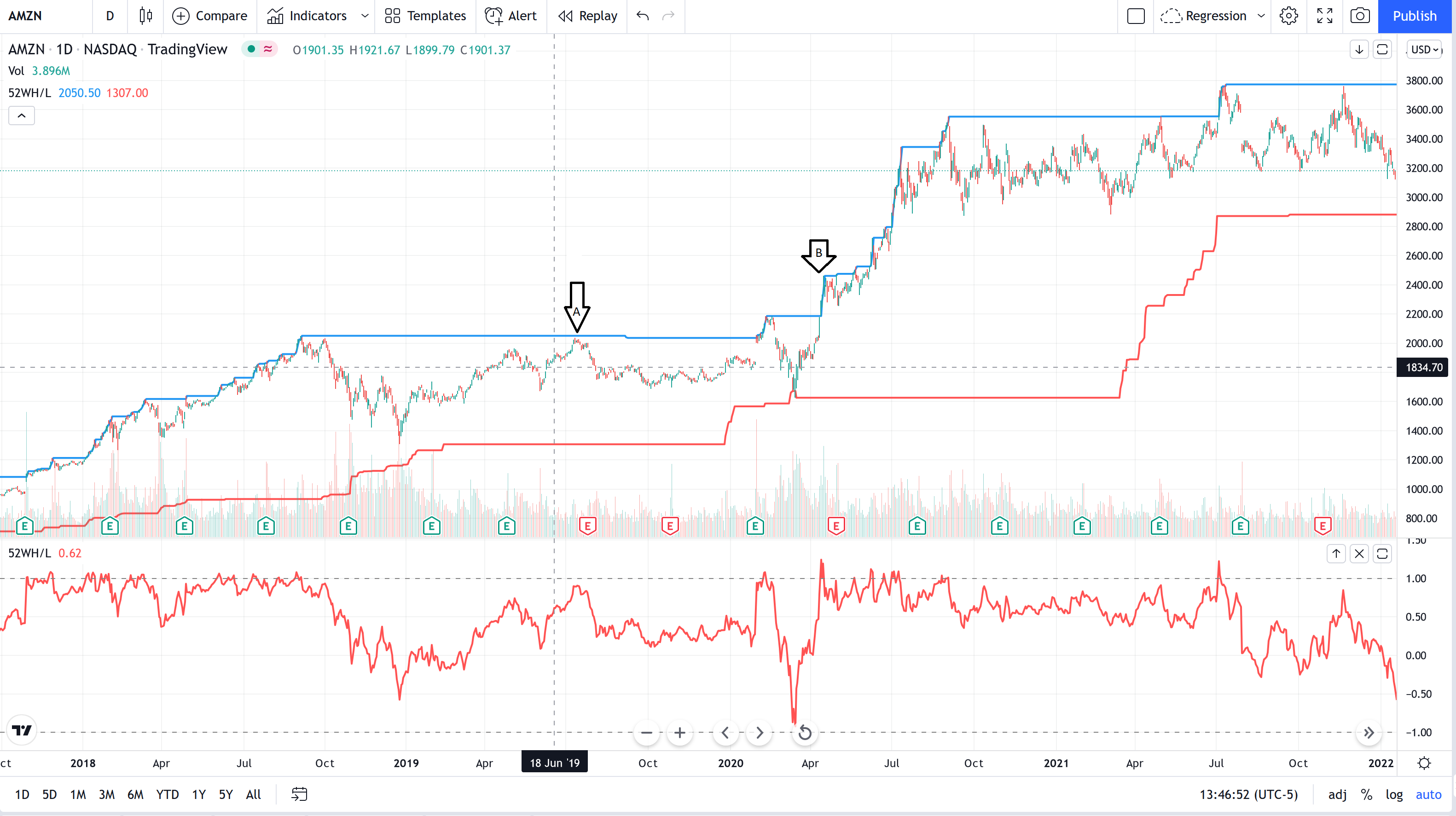

Donchian suggested that markets move on 4 weeks cycles, such that when a stock ranks at the top of the last 4 weeks, it will result in a price momentum, marking a good entry point for long trades. Exits should be taken when price hits the last four weeks bottom. See image below.

The problem of the raw rule is that by exiting at the bottom of the last four weeks, there are not as much gains, as if to exit earlier. As such, it is recommended to look for alternative points of exit.

Figure 14.10: Four week rule

52 weeks high lows

When a stock gets closer to the highest or lowest price of the past 52 weeks, large volatility is expected.

If it gets closer to the highest 52week price, it is likely because of strong fundamentals and/or positive news, which may then allow the stock to keep moving up. It has also been suggested that acquisitions are likely to move forward for the stock company near its 52w high. Altogether prices may continue to go up (Arrow B in the plot below).

The other possibility at the 52week high, is that long positions get closed to secure profits; and the massive sell off can trigger a price reduction (Arrow A in the plow below).

Differentiating between these alternative options can be done with the use of candles. For instance, if price surpasses the 52week high, but at the end of day closes below it, it should happen with a shooting start candle (Price was force high but did not succeed).

Figure 14.11: Relative to 52 Weeks HighLow

Similar volatility can be expected when a stock reaches its lowest price in the last 52Weeks. Price near the low 52w can force traders to close short positions (that is likely as low as price will get); in turn massive buying can trigger price increase (Arrow A). The opposite is also likely, when the price continue to go down (Arrow B). Perhaps a hammer candle should can help differentiate between these alternatives.

Figure 14.12: Relative to 52 Weeks HighLow

One study showed that when an entire sector nears its 52-week high, individual stocks within that sector are likely to see excess gains that are higher than stocks that breach 52-week highs in a mixed or downtrodden sector.

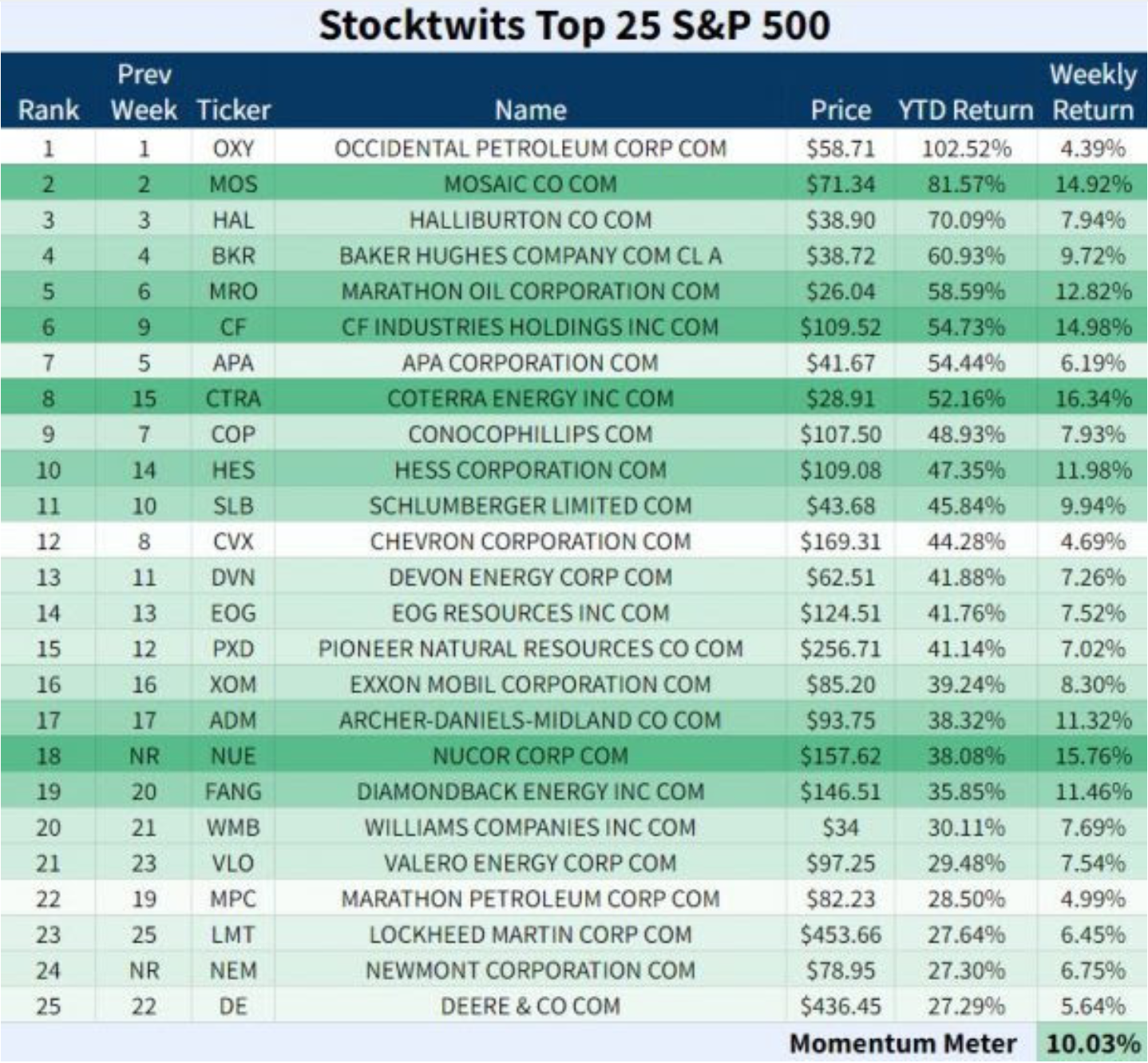

Momentum in weekly winners and lossers

Rather that looking at current price relative to last year or last month, this indicator looks at the winners from last week. Several studies have indicated that after a given stock ranks at the top or bottom of all stocks weekly (winners and losers), results in predicable patterns of price change during the following weeks.

This idea is at the core of “The Stocktwits Top 25 reports”, which is realease each saturday by Stocktwits.

Figure 14.13: ST Top 25 S&P 500